Company

Have you ever thought about the impact that the lack of US dollars in the global financial system could have on small and medium-sized businesses?

.png)

Have you ever thought about the impact that the lack of US dollars in the global financial system could have on small and medium-sized businesses? These companies are the critical engines of economic growth in emerging markets, but they're currently facing significant challenges. With the current dollar shortage, they're finding it increasingly difficult to access the financing they need to grow and compete in the global marketplace. Let's take a closer look at the impact of the dollar shortage on these businesses and explore some potential solutions.

The struggle is real for many small and medium-sized businesses around the world. Imagine a small clothing manufacturer in Argentina or Kenya, where the latest fashion trends meet traditional craftsmanship. The company relies on importing raw materials from India, such as cotton and fabrics, to produce their high-quality garments that sell in international markets. But lately, they've been hit hard by a major challenge - the current US dollar shortage. This shortage is a situation where there's a lack of US dollars available in the global financial system, and it's caused by various factors. Changes in global trade patterns, shifts in monetary policy from central banks, and the strength of the US dollar all contribute to this predicament.

One of the most significant impacts of the dollar shortage on small and medium-sized businesses is reduced access to financing. Many of these businesses rely on US dollar-denominated loans to finance their operations and expansion plans, particularly those that import goods or services from the US. The shortage of US dollars in the global financial system makes it more difficult and expensive for these businesses to access financing, as lenders may be less willing to lend in currencies other than the US dollar, or may require higher interest rates and greater collateral.

Furthermore, the dollar shortage can exacerbate currency volatility, particularly in countries with weak or unstable currencies. This can make it more challenging for businesses to plan and execute international trade transactions, as they face uncertainty and risk related to exchange rate fluctuations. This, in turn, can lead to higher transaction costs and reduced profit margins, making it more difficult for these businesses to remain competitive in the global marketplace.

Small and medium-sized enterprises, such as the clothing manufacturer in Argentina or Kenya, are the backbone of economic growth in emerging markets. The US dollar shortage has made it challenging for these businesses to sustain their operations, hampering their ability to access financing and navigate currency volatility. The shortage of dollars can also deepen existing inequalities within countries, resulting in a two-tiered economy, with larger companies with more resources able to withstand the effects of the dollar shortage. This instability can also result in small and medium-sized enterprises being more vulnerable to economic shocks and crises.

One solution to address the dollar shortage and its impact on small and medium-sized enterprises is to increase access to non-dollar-denominated financing options, such as loans denominated in local currency. However, this solution has some potential drawbacks. For example, it may be more difficult to find lenders willing to provide non-dollar-denominated loans, especially for small and medium-sized enterprises with limited credit history or collateral. In addition, local currency loans may be subject to higher interest rates and greater currency risk, which could offset the benefits of avoiding dollar-denominated loans.

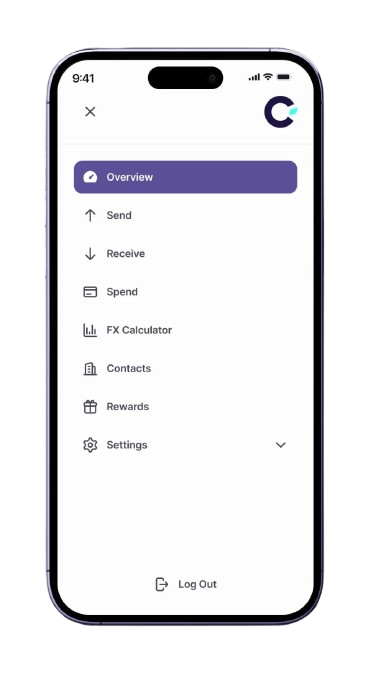

To overcome these challenges, small and medium-sized enterprises require innovative solutions that can provide them with reliable access to financing and international trade. Fortunately, technology and innovative financing solutions, like those provided by Cedar, are stepping in to bridge the gap. Cedar uses blockchain technology to facilitate cross-border payments and reduce transaction costs, making it easier for these businesses to access financing and engage in international trade. Cedar's platform also allows these enterprises to source US dollars for import and export, as well as deliver cross-border payments quickly, safely, and reliably.

By leveraging technology to create more efficient and accessible financing options, Cedar is helping small and medium-sized enterprises overcome the challenges created by the dollar shortage and build a more equitable global economy.