Company

When a supplier in Lagos tells you they can only release the container once payment clears, you suddenly understand how long settlement times become a tax on your business. Slow B2B settlement is not just annoying. It hits inventory, margins, relationships, your ability to move fast and affects your workflow.

Below are five reasons why faster settlement matters, and practical ways to get it under control.

Think of settlement time as inventory you pay for but do not yet control. Every extra day a payment is in limbo increases the cash you must hold to run the business. That ties up funds you could otherwise use to buy new stock, run promos, or hire.

How to get it: Use providers that offer faster corridor settlement and predictable timing. For instance, Cedar Money offers T + 1 settlement time to send funds to 190+ countries from Africa and receive funds from 9 major African markets.

FX rates move. The longer you wait to convert or settle, the more exposed your business is to rate swings. For importers, that can mean paying substantially more in local currency; for exporters, that can reduce the local-currency value of sales already booked.

How to get it: Adopt real-time FX tracking and use rate alerts, forwards, or the ability to hold multi-currency balances so you convert when the rate works for you. Use partners that offer competitive, transparent FX so you do not rely on late conversions that erode margins.

Vendors remember who pays reliably. Late or uncertain payments strain trust and push suppliers to prioritize other buyers, increase prices, or demand stricter terms. In markets with thin liquidity, slow settlement can even interrupt supply chains.

How to get it: Give suppliers a clear SLA and provide instant payout confirmations. Where possible, offer batch scheduling or automation so payments happen on time without manual chasing.

Financial institutions and fintechs can integrate Cedar’s API for automated, frictionless transactions. This aggregated API provides access to multiple global payout partners, enabling these companies to off-ramp stablecoins to fiat currencies efficiently.

Every delayed, partial, or transformed payment makes reconciliation more difficult than it should be. Different intermediary fees, rounded amounts, historic FX conversions, and missing payment references create long manual processes and errors in the books.

How to get it: Choose a provider that returns consistent payment references. APIs that push payment and remittance data directly into your accounting or ERP system remove copy/paste and reduce human error.

Markets move fast. A supplier discount, a favourable FX window, or a seasonal buying opportunity can evaporate in days, or even hours. Fast settlement means you can act quickly rather than apologizing for a missed chance.

How to get it: Keep a portion of your funds in the currency corridors you most frequently use, or use a partner that offers same-day or near-real-time settlement in key corridors. Pair that with role-based controls so approved team members can execute when time matters.

Many Cedar Money customers pair corridor liquidity with multi-user controls. This removes approval bottlenecks while retaining governance and approved team members can push payments without a dozen back-and-forths, and managers retain visibility and control.

A modern cross-border payments platform is not just a rails provider. It is a workflow tool. The right partner gives you predictable settlement times, transparent fees, multi-currency control, and integrations so your finance team stops being reactive and instead, stays pro-active.

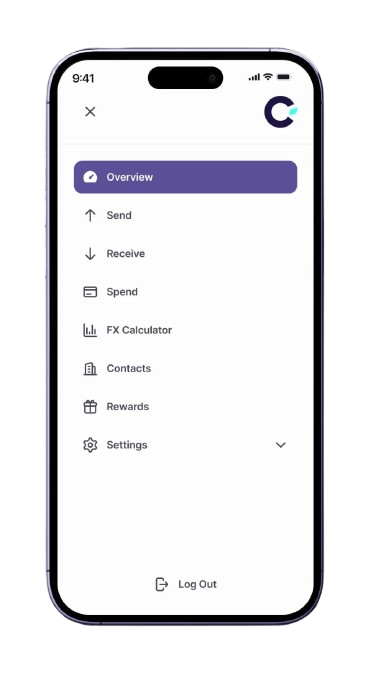

Cedar Money was built for businesses that need those exact things: predictable corridor coverage across the countries you trade in, multi-user role controls to avoid approval bottlenecks, real-time FX visibility, and faster settlement times. You get a single dashboard that replaces the scramble of bank portals, spreadsheets, and messaging apps when making cross-border B2B payments.

Slow settlement eats cash, damages relationships, increases operational costs, and leaves business leaders reacting instead of deciding. Faster settlement gives you breathing room, clarity, and the ability to move when opportunities appear.

Ready to stop waiting on payments? Get started with Cedar Money and see how faster settlement can free up cash and time for your business.