Company

For any business looking to build globally and expand beyond their country or continent’s borders, they require a strong, scalable infrastructure. Think: scalable payment solutions, cloud-based stacks, logistics and supply chains, and much more, depending on the industry and business model.

Of all these, payments remain one of the biggest and most common friction points when expanding across borders. With global payment volumes projected to reach $290 trillion by 2030, the pressure on payment scalability is only intensifying.

Behind the simple act of sending money from one account and receiving it in another lies a lot of complexities. And when this payment has to cross borders? These are heightened: varying country regulations, high cost and routine delays.

That’s why scalable payment solutions are non-negotiable for businesses serious about growth.

In this article, we will show you what makes a payment solution truly scalable and why it is essential, regardless of your business’ size.

Have you ever thought about how electricity or water gets to your home? You just plug in a device, or turn on the tap, and it's there. You don't worry about the power plant or the network of pipes underground that make it all possible.

Payment solutions work similarly: they're the invisible infrastructure that allows your money to move with just a click of a few buttons.

Now, imagine if your electricity could only power one small light bulb, but suddenly you need to power a whole building. That's the difference a scalable payment solution makes. It is built to effortlessly grow with your business ensuring your money flows securely and efficiently, no matter the volume or destination.

Put simply, a payment solution is the system or infrastructure that lets businesses send, receive, and manage money. This could be through bank transfers, mobile money, card payments, or API-driven platforms.

A scalable payment solution goes a step further. It is built to:

You run a Kenyan skincare startup that sells handmade, all-natural products online to customers in the UK and EU. In the early days, orders trickled in by the dozen and your small team manually processed payments, tracked them in spreadsheets, and kept everything organised across multiple Google folders.

Then everything shifts when a popular UK-based beauty blog features some of your products. All of a sudden, a couple of TikTok creators jump on the trend and pick up your products. Just like that, your brand becomes an internet sensation, your followers shoot through the roof, you’re tagged in haul videos and show up in multiple beauty must-have lists.

Within weeks, you’re flooded with orders and your business is processing three times the usual order volume. Or at least, it’s trying to.

Now, you’re dealing with:

What was once a simple setup is now under serious strain. The friction starts to show up everywhere: settlement delays, failed transactions, and frustrated customers.

This is where a scalable payment solution becomes critical. You need infrastructure that grows with your momentum: handling increased volume, supporting multiple currencies and payout methods, and giving you real-time visibility into your cash flow across borders.

And it needs to do all that without forcing you to overhaul your operations every time you grow. Because if your payment stack can’t scale, neither can your business.

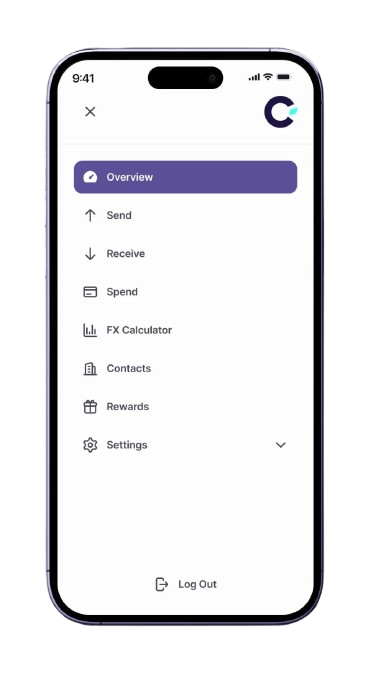

At Cedar Money, we’ve built an infrastructure that was designed from the ground up specifically for businesses moving high volumes across borders— and plan to grow.

Here’s why businesses switch to Cedar Money and never look back.

Whether you're a startup expanding from Kenya into Europe or a global company collecting payments across Africa, Cedar gives you the scalable foundation you need to move fast and stay in control.

Here is everything you should look for in a scalable cross-border payment partner:

Now, here’s everything Cedar Money offers to support your cross-border growth:

1. Multi-Currency, Multi-Country Coverage

Cedar supports transactions in 190+ countries for outbound payments and lets global businesses collect from 9 African countries, including Nigeria, Kenya, Ghana, and South Africa. This means you can serve customers and pay suppliers around the world without needing separate accounts or partners.

2. T + 1 Settlements

Our infrastructure is built for speed. Whether you're paying suppliers in Nairobi or receiving funds from clients in London, Cedar ensures fast, predictable settlement (in just 24 hours) so your operations never stall due to slow payments.

3. Automated Compliance and Enhanced Security

Cedar handles the heavy lifting of regulatory compliance, with real-time KYC/AML checks and multi-factor authentication built in. That means less manual review, fewer delays, and safer transactions.

4. Transparent Pricing That Protects Your Margins

No hidden fees. Cedar offers competitive FX rates and transparent pricing, so you always know what you're paying and can plan accordingly.

5. Real-Time Tracking and Payout Confirmations

You get full visibility over your payment flow with real-time dashboards and automatic payout confirmations. This enables trust and builds your relationship with partners and vendors.

6. Developer-Friendly APIs and Seamless Integrations

Our Payout API makes it easy to plug Cedar directly into your backend systems. Whether you're automating payroll, or supplier disbursements, you get to scale without adding operational complexity.

7. Built to Scale With You

From your first international sale to global expansion, Cedar grows with you. Whether you're sending or receiving $3M or $30M transactions per day, our systems stay responsive, reliable, and ready for more.

Growth isn’t just about demand, it’s about having the right systems in place for your business to remain sustainable.

When your business takes off, you need more than just your great products. You need infrastructure that won’t crack under pressure. That’s where scalable payment solutions come in: they ease the friction and give you the clarity and control you need to focus on expansion.

At Cedar Money, we help cross-border businesses do just that: grow smoothly, securely, and sustainably. Whether you're navigating compliance in new markets, sending payouts across multiple countries, or collecting in different currencies, we’ve built a platform that scales with your business needs and ambition.

So when that next spike in demand hits, you’ll be ready. Get started now.